Utilize this link for managing accumulative vacations that an employee may take outside the country. Therefore, some organizations tend to settle all employee-pending issues, in order to give the employee all his/her earnings before taking this vacation. Note that, this wizard can be utilized only in case the organization applies the logic of the (Advance Vacation), which is mostly applied at the Gulf area.

My Daily Work à Employee Files à Payroll “function area” à Leave Wizard

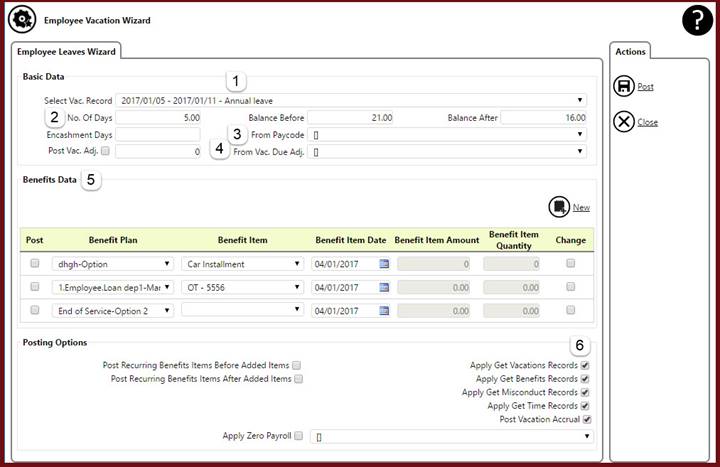

1. Select the relevant vacation record; displayed in terms of (Vacation From- To dates – Vacation Type Name).

2. Accordingly, the system will retrieve the requested number of days at this vacation record, the employee balance before this vacation & his/her balance after taking this vacation.

3. In case the organization policy dictates encashment for employee remaining balance or for due till the current month, then a user can insert the number of encashment days & select the relevant paycode for encashment.

ü N.B. Some organizations grant employee salary in advance for the entire vacation duration, via adding those days to the ‘Encashment Days’ field. Others do grant full encashment for the employee remaining balance (Balance After) or settle vacation encashment YTD (From the beginning of the year till the vacation month).

4. Insert a Due Adjustment record which may take place as follows:

ü In case vacation encashment will take place during this process, a relevant due adjustment days will be entered to settle employee vacation data.

ü In case of cashing days equal to or more than the vacation period displayed at the (No. of Days) field. Then due adjustment can take place for vacation encashed days and not advance salary days.

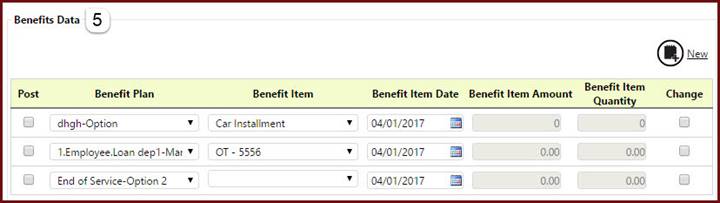

5.

Benefit Data section will list all

benefit records at which this employee is enrolled. Verify items amounts before

posting via provided check boxes.

6.

Also a user may append additional

records for benefits data, via provided ‘New’ link through this form, as the

system will add an empty record at the end of the grid, as shown above.

7.

Posting Options: check any of the

provided options for posting recurring items whether before or after adding

benefit items.

8.

Zero Payroll: Select (Zero

Payroll) paycode to signify that the employee will take his/her salary now

after applying all deductions, before the end of the month. Note that, this

(Zero Payroll) paycode is a deduction paycode at which the system will post the

employee Net Salary amount after settlement. Hence, this employee will be

excluded from payroll calculation at the end of the period, as s/he has already

received settled earnings before the end of the payroll period.

9.

Check mark the required batch action

that will be applied to Get Records from any of the following modules,

so that it can have the proper impact on payroll.

10.

A user can choose to Post all

specified actions, to finalize this process.